Booking an Ola Cab?

Estimate your ola fare, ola mini vs. ola prime, compare ola services & prices, avoid ola peak time surcharge pricing, save money on your ola rides.

How much does an Ola Cab cost? Which Ola Cab service is right for me?

OlaFareFinder calculates the cost of your Ola ride in over 100 supported cities. Simply enter your pickup and dropoff locations to get the price estimate of a variety of Ola Cab services (Ola Mini, Ola Sedan, Ola Prime, etc) available in your area.

Check Ola peak time surcharge pricing! OlaFareFinder will even warn you if peak time pricing is currently enacted in your location.

Ola fares from {{ origin_data.address }} to {{ destination_data.address }}

Trip is {{ trip.distance.value / 1609.34 | number : 1 }} mi, {{ trip.duration.value / 60 | number : 0 }} mins, ola {{ r.display_name }}, includes the following surcharges:, {{ surcharge.name }}: {{ surcharge.value_text }}, no surcharges for this trip, 🕙 {{ r.time_estimate_minutes }} minutes away, unavailable at this time, join the club.

Keep up to date on the latest taxi and rideshare news by signing up for the RideGuru e-newsletter!

Subscribe to our mailing list

What is Ola?

OlaCabs, or more commonly referred to as Ola, is an online, on-demand car service based in Bangalore, India. Ola provides riders with a variety of car services, ranging from their ultra-affordable Ola Micro service to their luxury business class option, Ola Prime.

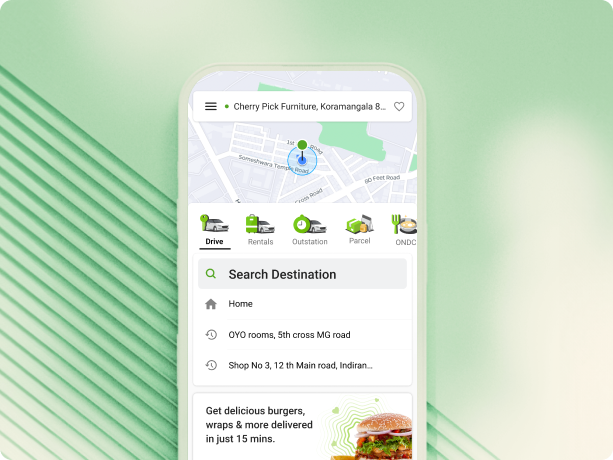

Ola cabs are requested and booked through the Ola smartphone application via the touch of a button. Once a customer books their Ola car, they will have the option to pay via cash or with Ola money. Ola money is a cashless form of payment within the app, which allows a customer to buy Ola credit (via their credit or debit card) to use towards Ola rides.

Ola cab prices are very reasonable but occasionally when Ola cabs are in high demand the company may enact peak time surcharge pricing. Peak time pricing could double or even triple your fare depending on the surge amount. Luckily, Ola will always warn you if peak time pricing is in effect before you decide to book one of their cars.

Ola Cabs is currently available in over 100 cities across India.

What cities does Ola support?

- Visakhapatnam

- Tiruchirappally

- Tirunelveli

- Bhubaneswar

- Hubli Dharwad

- Kurukshetra

- Thiruvananthapuram

- lego_ignore

- Pondicherry

- Rajamahendravaram

- second_change

- Durg Bhilai

What rideshare services does Ola offer?

Ola’s newest and cheapest service. When you select an Ola Micro, a compact car with seating for up to 3 people will pick you up.

Some of the vehicles you might ride in when using are:

Hyundai Eon • Wagon R • Datsun Go

Another low cost service, though slightly more expensive than Ola Micro. When you select an Ola Mini, an air-conditioned compact car with seating for up to 3 people will pick you up.

Tata Indica • Vista • Ford Figo

This is Ola’s flagship taxi service. Ola Prime is aimed at regular city travelers who are looking for a more spacious ride than the Micro or Mini. When you select an Ola Prime, a sedan class car with seating for up to 4 people will pick you up.

Suzuki DZire • Mahindra Verito • Toyota Etios

Olacabs Blogs

Easier online payments for your ola rides during the trip.

Clearing past ride payments when you’re in a hurry to book your next ride can be a hassle. Which is why, Ola brings to you an easier way of clearing all your payments. You can now pay during your ride with your Credit card, Debit card or UPI payment options! If you haven’t paid during the ride, you can always pay at the end of your trip in cash. Sounds smooth?

Here’s how it works:

Step 1 Book a ride and select your Card/UPI account as the payment option.

Step 2 Click on “Pay Now” after the ride starts.

Step 3 Enter CVV and OTP to authorize the payment.

Step 4 You’re done!

Have queries? Reach out to us on [email protected]

Leave a Reply Cancel reply

Your email address will not be published. Required fields are marked *

Save my name, email, and website in this browser for the next time I comment.

Now use Ola for managing your Corporate Travel

Its Easy, Safe and Efficient

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Frequently Asked Questions

Peak Time Charge

Ola Money Postpaid

- Cancellations

India T&C

- Ola Auto Saas T&C

- Ola Parcel T&C

- Ola Corporate T&C

- Ola General T&C

India Privacy Policy

- AU Corporate T&C

- AU Ride Advantage T&C

- AU Ola Pass T&C

AU Privacy Policy

- NZ Corporate T&C

- NZ Ride Advantage T&C

- NZ Ola Pass T&C

NZ Privacy Policy

- UK Corporate T&C

UK Privacy Policy

- Offer Specific T&C

Referral Scheme T&C

Bookings Related

Q: Do I need to register on your site to book tickets?

A: No. You can use our service fully without the need to register. You just need to provide your details at the time of booking.

Q: What if the car doesn't show up?

A: In case the vehicle you booked doesn't show up, we will offer you a full refund immediately.

Q: What if the car shows up late?

A: We try our best to ensure our partners reach our customers on time. But in case of delays, do call us and we will help you out by either providing an alternate vehicle or giving you a full refund.

Before knowing about OLA’s peak time charge, it is important for you to know how OLA works.

OLA’s business model

OLA is an online marketplace for drivers.

These drivers are independent and they are either self-employed (own their commercial vehicles), or work for an Operator who owns multiple cars.

Like you have an OLA app on your smart phone to book a cab, these drivers have a similar Driver mobile App on their smart phones. We activate the Driver app after a thorough check of authenticity and conducting due diligence of the commercial & personal papers of the driver & operator. These drivers decide their own time to login to the OLA application and accept requests for rides from customers. They may choose to remain logged out of the system as per their convenience.

Q: What is OLA’s peak time charge?

OLA being a marketplace doesn’t control the number of vehicles online on its system/platform; drivers & operators are independent & work as per their convenience. During a normal day when demand & supply are met, there is no need to put an extra effort to pull the supply side of vehicles.

OLA has observed that during certain times of the day, when more traffic is on road, routine drivers tend to log out of the system to suit their convenience as there is no incentive for them to put an extra effort. Similarly, when demand suddenly increases, not enough drivers might be available on the road. Customers might be inconvenienced by not being able to find cabs during such times.

As a system/solutions provider OLA has limited options to motivate the drivers and cater to the high demand timings & scenarios. OLA has observed that the drivers are very sensitive to little extra earnings for their extra effort to stay logged in to our system.

OLA applies an X multiplier or flat surcharge to the normal fare based on various situations and scenarios like place of pickup, time of pickup, type of vehicle, demand situation, supply scenario etc. Using advanced analytics, unique algorithm, past ride experiences etc. the OLA software calculates an appropriate surcharge to apply over and above the normal fare. This enables OLA to come up with appropriate incentives to drivers to make them stay logged in to the system for the additional earnings. This enables customers to get their much needed service even during peak times when demand for cabs is high.

The peak time surcharge works in two ways

a) It motivates drivers to stay & serve for a longer time even during difficult hours of the day and when demand is high.

b) It filters out the less needed rides hence making the vehicle available to those who really need a cab.

Transparency

OLA is transparent about the rates. OLA makes sure that customers are aware of the dynamics of peak time charge and how it works. Whenever peak time charge is applicable; customers get a clear intimation, to confirm their intent to avail the ride at a higher price than normal. The booking process is initiated only when they confirm; hence, if a customer wants to avoid that ride he/she may choose to do it, thus making the cab available to others who are in need.

Please click on below link for Ola Play Terms and Conditions :

Ola Play TNC

Please click on below link for Ola Credit Terms and Conditions :

Ola Credit TNC

Please click on below link for Ola Money Postpaid Terms and Conditions :

Ola Money Postpaid TNC

Cancellation Policy

If you feel that you were charged a cancellation fee incorrectly, you can request a Cancellation Fee Waiver. Please click here to know how you can request a Cancellation Fee Waiver.

A cancellation fee is charged to compensate drivers for the time, effort, and fuel spent while trying to reach the pickup location.

You may be charged a cancellation fee if any one of the following occurs: (a) a trip is canceled after 3 (three) minutes or later from the time of acceptance of the ride by the driver or

(b) a driver cancels the booking after waiting at your pickup location for 5 minutes or more

However, the cancellation fee will not be charged if the driver is delayed in reaching the picking-up location by more than 5 minutes from the shown estimated time of arrival.

The cancellation fee amount may vary depending on your city, and the vehicle category selected.

A cancellation fee, if charged, will be added to the total bill amount of your next Ola ride.

India Terms and Conditions

Please click on below link for Olacabs India Terms and Conditions :

Ola Auto Saas Terms & Conditions

Please click on below link for Ola Auto Saas Terms and Conditions :

Ola Auto Saas Terms and Conditions

Ola Parcel Terms & Conditions

Please click on below link for Ola Parcel Terms and Conditions :

Ola Parcel Terms and Conditions

Rajasthan Fare Notification

Please click on below link for Rajasthan fare notification :

Rajasthan Fare

Ola Corporate Terms & Conditions

Please click on below link for Corporate Terms and Conditions :

Ola Corporate Terms and Conditions

Ola General Terms & Conditions

Please click on below link for Ola General Terms and Conditions :

Ola General Terms and Conditions

Please click on below link for India Privacy Policy Terms and Conditions :

AU Terms and Conditions

Please click on below link for Ola AU Terms and Conditions :

AU T&C AU Corporate T&C AU Ride Advantage T&C AU Ola Pass T&C

Please click on below link for AU Privacy Policy Terms and Conditions :

NZ Terms and Conditions

Please click on below link for NZ Privacy Policy Terms and Conditions :

NZ T&C NZ Corporate T&C NZ Ride Advantage T&C NZ Ola Pass T&C

Please click on below link for NZ Privacy Policy Terms and Conditions :

UK Terms and Conditions

Please click on below link for Ola UK Terms and Conditions :

UK Corporate T&C UK T&C

Please click on below link for UK Privacy Policy Terms and Conditions :

Privacy Policy How we process your data To whom we transfer your data Cookies And Other Technologies

Offer Specific Terms & Conditions

Last Updated: 7th OCT 2015

These general terms & conditions of offer ("General Offer Terms") shall constitute a legally binding and enforceable contract between the Customer availing the Offer ("Customer(s)/ You/ Your") and ANI Technologies Private Limited ("OLA") . You are not bound in any way to participate in the Offer. By availing the Offer, You unequivocally accept to be bound by the terms set out below. The participation is voluntary and any purchase or transaction on the OLA Platform shall be deemed as acceptance of the terms and conditions mentioned herein. These General Offer Terms along with any other offer specific terms as may be issued by OLA from time to time shall constitute the entire understanding between OLA and You and these General Offer Terms shall supersede any other offer specific terms in the event of conflict unless such offer specific terms expressly supersede these General Offer Terms.

The offer is valid ONLY on OLA Mobile Application and can be availed on cab Services and shall not be applicable to the black and yellow taxi (Kaali Peeli), Taxi for Sure cabs unless expressly communicated by OLA otherwise. The taxi/cabs services (“Services”) provided by third parties on the OLA mobile application (“OLA Platform”) shall be the responsibility of the third party providing the Services and all claims shall be against that third party (“Service Provider”) providing the service to which the offer applies. Offers shall not be clubbed with other Offers as a matter of OLA’s policy. You shall become ineligible to participate in this Offer if You are barred from using services of OLA during Offer Period. OLA reserves the right to disqualify any Customer from the benefits of the Campaign/Offer, if any fraudulent activity is identified as being carried out by the Customer for the purpose of availing the benefits under the Campaign/Offer or otherwise by use of the service. OLA disclaims all warranties, conditions or statements, whether express, implied or statutory, including, without limitation, the implied warranties or conditions of merchantability, quality and / or fitness for the products or services included in this Offer, the Services or for any other purpose. Limitations: Pictures of products shown in the communication sent to the Customer either through mailers or advertised on OLA website, are for representation purposes only and may not bear a resemblance to the actual Services provided by the relevant Service Provider. OLA shall under no circumstances be responsible towards the same. Services offered under this program are subject to availability from the respective Service Provider in relevant geographical location and in no circumstances OLA shall be liable for non-availability of any of the Services. Under no circumstance will the Offer/Discount being offered under this Program be settled or exchanged in cash or through OLA Money. All liability with respect to the Services availed lies solely with the respective Service Provider. OLA or the Service Provider shall not be liable for any indirect or speculative or consequential or penal damages, including, but not limited to, any loss of use, loss of data and loss of income or profits, irrespective of whether it had an advance notice of the possibility of any such damages. Notwithstanding anything contained in this General Offer Terms, the total liability of OLA and the Service Provider, shall not, in any circumstances, exceed the Rs. 1000/- (Rupees One Thousand only), irrespective of the nature of the claim which results in such liability and whether based on contract or tort or any other theory of law. The Offer shall be subject to usual force majeure events. OLA may at its sole discretion refuse, deny, discontinue, withdraw and terminate the Offer at any time during the Offer Period without assigning any reasons whatsoever and without any prior notice to You. All disputes shall be settled amicably, on failure to do so within 30 (Thirty) days, such disputes shall be resolved by a sole arbitrator appointed by mutual agreement of the parties. The proceedings of the arbitration shall be conducted in accordance with the provisions of the Arbitration Conciliation Act, 1996 and the seat of arbitration shall be Bengaluru, India. Subject to the aforesaid, these General Offer Terms read with the offer specific terms shall be governed by the laws of India and the courts in Bangalore, Karnataka shall have sole and exclusive jurisdiction.

Terms and conditions, Privacy policy for Customers Terms and Conditions for Merchants By accepting the terms and conditions of ANI Technologies Private Limited (“ANI”) provided hereunder, and by registering on ANI’s mobile application/ website (https://www.olacabs.com) , You/user hereby explicitly and simultaneously choose to create an ‘OlaMoney Powered by Zipcash’ wallet account with Zipcash Card Services Private Limited (“Zipcash”), which is subject to the applicable terms and conditions of Zipcash available through the above link (“Zipcash T&Cs”). You hereby also accept and agree to be bound by the Zipcash T&Cs at all times.

Please click on the below link for Ola Maps data attribution :

Ola Maps Data Attribution

The customer agrees and acknowledges that the use of the Mobile App/Website is at the sole risk of the customer and that Company disclaims all representations and warranties of any kind, whether express or implied as to condition, suitability, quality and fitness for any purposes are excluded to the fullest extent permitted by law.

The information contained in this Website / Application is for general information purposes only. The information is provided by Ola and while we endeavor to keep the information up to date and correct, we make no representations or warranties of any kind, express or implied, about the completeness, accuracy, reliability, suitability or availability with respect to the website or the information, products, services, or related graphics contained on the website for any purpose. Any reliance you place on such information is therefore strictly at your own risk.

In no event will we be liable for any loss or damage including without limitation, indirect or consequential loss or damage, or any loss or damage whatsoever arising from loss of data or profits arise out of, or in connection with, the use of this website.

Through this website you are able to link to other websites which are not under the control of Ola. We have no control over the nature, content and availability of those sites. The inclusion of any links does not necessarily imply a recommendation or endorse the views expressed within them.

Every effort is made to keep the Website / Application up and running smoothly. However, Ola takes no responsibility for, and will not be liable for, the Website / Application being temporarily unavailable due to technical issues beyond our control.

Please click on below link for Referral Scheme Terms and Conditions :

Referral Scheme TNC

Form MGT-7 Notice of 10th AGM Notice of 11th AGM

Form MGT-7 Notice of 9th AGM Notice of the EGM

GST on Cab and Taxi Services

- Author - Rohit Pithisaria

- Last Updated - January 18, 2020

Table of Contents

I ntroduction.

As per the GST Act, Cab services are taxable services. When services are provided via cab aggregators like Ola or uber then also GST is chargeable.

However, metered taxi and auto rickshaws are exempt from GST including Ola Auto.

In this article, we will try to cover every point related to GST on taxi and cab services including cases when cab service is provided as part of tour package.

There are two options with the service provider regarding GST Rate

Option – 1: Pay GST at a rate of 5%. In this option, the person is allowed to take input tax credit of only GST paid on cab services taken from other persons. Any other GST paid cannot be taken as input tax credit and will simply lapse.

Example – ABC Ltd, a cab service provider, enters into an agreement with XYL Ltd, a corporate entity. ABC Ltd. doesn’t have its own cars, so they take cars from MNR. In the given case MNR will charge GST at the rate of 5% from ABC Ltd. and ABC Ltd. will charge GST at the rate of 5% to XYL Ltd. and ABC Ltd. will take credit of GST paid to MNR because the service provider is in the same line of business but ABC Ltd. will not be able to take credit of GST paid on telephone bill.

Option – 2: Pay GST at the rate of 12%. In this option, the person is allowed to take input tax credit of all input goods and services subject to general restrictions on the use of input tax credit.

Example – In the example given above, ABC Ltd. can take credit of GST paid on telephone bill if they pay GST at the rate of 12% on outward supply of service.

There can be a case when the customer is charged based on fuel plus service charges. In that case, GST is to be charged at a rate of 18% on service charges. No GST is applicable on fuel part in that case.

Case in which GST is payable on Reverse Charge by Service Receiver

A person who is not a body corporate and opted to pay GST at rate of 5% is not required to pay GST on providing services to a body corporate. Such body corporate has to pay GST on reverse charge basis on such services. (This rule is applicable from 1st October 2019)

For example: An individual is registered in GST and provides services to a private limited company. He is not required to charge GST in the invoice. He just charge amount for services and mention that “GST payable on Reverse charge basis” in the invoice.

Place of Supply for Rent a Cab

Place of supply for services provided to a registered person is the place of such registered person, i.e. place of the recipient. For example – A cab service provider registered in Delhi gives service to a person registered in Rajasthan in the state of Gujarat. The place of supply in such case will be Rajasthan even when the service is provided in Gujarat.

If car rental services are provided to the unregistered person, then the place of supply will be the location where the passenger embarks on the conveyance for a continuous journey, i.e. the state/UT where the passenger starts his journey.

If the right to passage is given for future use and the starting point is not known at the time of issue of the right to passage, the place of supply of such service will be location of the recipient if the address is available on record. If such an address is not available, then the location of the service provider is place of supply.

GST on Ola, Uber and drivers operating through them

GST is payable on cab services provided through Ola or uber.

Such service is covered under Section 9(5) of CGST Act. Section 9(5) states that the e-commerce operator (Ola, uber) is required to collect and pay GST to the government rather than the person who is providing cab service.

Therefore, cab drivers are not required to collect and pay GST.

Also, such drivers are not required to get registered even if the turnover is more than the specified limits. So, if a person is operating five cars through uber and has a turnover of Rs. 25 lakh then also he is not required to register.

If a driver is registered then also he is not required to collect GST for service provides via Ola.

ITC by service receiver

GST paid on rent a cab service is specifically disallowed under Section 17(5) of CGST act. Therefore, such GST paid cannot be taken as input tax credit. However, if the service receiver is also cab services provider then he can take input credit of such GST.

Corporate Service by OLA and Uber

Ola & Uber also provide cab services to corporate entities. In this case, Cab aggregators take services from cab drivers and provide it to corporate.

Cab aggregators will give fees to cab drivers and later they will reimburse it from the corporate vide issuing debit note.

Further, cab aggregators will collect commission by issuing commission invoice to corporate for providing technology aggregation services to them.

Cab aggregator will charge GST at the rate of 5% on reimbursement debit note and 18% will be charged on commission invoice.

The corporate cannot take ITC of GST paid on reimbursement debit note but they can take credit of invoice issued for commission charges for the use of Technology aggregation services of cab aggregator.

Let us understand this with an example:

Ola, a cab aggregator, has entered into an agreement to provide service to reliance industries. Ola doesn’t have its own cabs; they use aggregation technology platform by which M/s. Akash cars is able to provide cab service to Reliance Industries on behalf of Ola. The transaction will be done as follows:

Services by Tour Operators and Tour Agents

Tour operator may provide a bundle package to its customers. For example – A tour operator gives a package of Rs. 50,000 to a person which includes hotel, cab and entertainment park tickets. Now the question is which GST rate is to be applied.

There can be four situations in this case as below

1) Tour operator sells a package and charges a flat fee – In this case, GST rate applicable on tour package will be applicable on total charges. For example – A tour operator gives a package of Rs. 20,000 which include hotel, cab etc. then GST rate applicable on tour package is chargeable on Rs. 20,000.

2) Tour operators sells a package and charge separately for all services – In this case GST rate as applicable on services is applicable on individual services. For example – The tour operator charges Rs. 10,000 for hotels, Rs. 5,000 for cab and Rs. 3,000 for entertainment park tickets. The GST rate as applicable on the hotel is chargeable on Rs. 10,000, GST rate applicable on the cab is applicable on Rs. 3,000 and so on.

3) Tour operator sells a package and acts as pure agent for some service – In this case, GST rate applicable as per point no. 1 and 2 above. And for service for which he is acting as pure agent will be shown as reimbursement. For example, a tour operator gives a package of Rs. 30K to a client. Tour operator doesn’t include cab service in this package. On demand by the client, he contacts a cab driver and driver told him charges or Rs. 8K. The tour operator charges this Rs. 8k from the client. In this case, he is acting as a pure agent and thus he need not charge GST on such Rs. 8k. Also, he is not entitled to Input tax credit for such service. There are certain conditions to be considered as a pure agent as below

- The payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service.

- The supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account.

- The person does not use for his own interest such goods or services so procured.

- He receives only the actual amount incurred to procure such goods or services in addition to the amount received for supply he provides on his own account.

4) If the tour operator is giving tour package services on a commission basis to the passenger – Some tour operator books all services on behalf of passenger and charges commission for such services. GST will be leviable at the rate of 18% on such commission.

Tour operator can take input tax credit for GST paid on cab services other than in case of a pure agent.

ITC on Car Purchased by Cab Owner

Input tax credit on cars purchased is specifically prohibited under section 17(5) of CGST Act. But it is available if the purchased car is used for taxable supply of transportation of passengers. Thus, ITC on car is available for cab owners in the month of purchase.

Also, note that persons opted to pay GST at rate of 5% cannot take such input. Only persons opted to pay GST at rate of 12% can take such input.

In case of service provided via Ola or Uber and car is purchased then taking ITC on car is not possible as the driver is not required to pay GST as discussed earlier.

GST on Lease paid by the driver

Ola & Uber, cab aggregators are providing leasing of car services to its drivers. Cab aggregator buys a car and gives it to the driver on lease to use it for transportation of passengers on Ola & Uber app.

The driver will pay minimum initial deposits and daily/monthly rent to the cab aggregators. This leasing program is covered under GST. Therefore, such GST is payable on such lease amount.

For example, Ola will buy a car and pay GST on that car. Ola gives it to the driver on lease. Ola will collect daily/monthly rent with GST from drivers. Ola will get the ITC of GST paid on a car purchased as it is used for transportation of passengers.

GST rate on cab services is 5%. Although, service provider can opt to pay GST at rate of 12% and take benefit of availing full input tax credit.

A person who is not a body corporate and opted to pay GST at rate of 5% is not required to pay GST on providing services to a body corporate. Such body corporate has to pay GST on reverse charge basis on such services.

A registered person cannot take ITC of GST paid on cab services. It is specifically disallowed under Section 17(5) of CGST Act.

Yes, GST is payable at rate of 5% on ola and uber rides.

Confused about complicated laws? Take our GST consultation services to get your issues solved from GST experts. Click here to know more.

Read More Articles

Section 44ada – presumptive taxation scheme for professionals.

From financial year 2016-17, a new Section 44ADA is introduced for presumptive income for professionals. This section is similar to section 44AD for traders. Under this section professionals such as legal, medical, engineering, architect, accountancy, technical consultancy, interior decoration or any

Registration Under GST

Topic Covered in this Article Persons required to register compulsorily Documents Required for Registration Fees for Registration Voluntary Registration Time Limit for Registration Effective Date of Registration Requirements for Registration Can a person take more than one GSTIN Things that

Refund of Unutilised Input Tax Credit for Zero-Rated Supplies

What is Input Tax Credit under GST? Input Tax Credit (ITC) means claiming the credit of the GST paid on the purchase of goods and services which are used for the furtherance of the business. ITC is a mechanism to

GST on Import

Article 269A of constitution mandates that import of goods or services in India is considered as Inter-state trade. Therefore, import of goods or services is considered as interstate supply and is liable for payment of IGST. IGST on the import

Rohit Pithisaria

We will send updates relating to gst only.

(No spam, you can unsubscribe anytime)

About taxadda

- TaxAdda started in 2011 by Rohit Pithisaria and currently providing all types of services related to Income Tax, GST, Accounting to clients all over India. Click here to know more.

registered office

- Janki Vihar Apartment, A-102, Shiv Marg, Near Satellite Hospital, Bani Park, Jaipur, Rajasthan 302016 Email - [email protected]

- Call & WhatsApp - 82396-85690

JavaScript seems to be disabled in your browser. For the best experience on our site, be sure to turn on Javascript in your browser.

Looking for an Outstation Cab ride?

Enjoy Up to 20% off on Your First Sign-Up!

Enjoy your road trip with Ola Outstation

Relaxing journeys are just a tap away.

2500+ routes covered

Schedule your ride 7 days before.

Starting price at just ₹9 km/hr

Choose a cab size based on your luggage

Book our fleet instantly or reserve for later. We are here to make your long distance travel rides affordable & comfortable

Comfortable, economical cars

1-4 passengers

Prime Sedan

Top comfortable sedans with extra luggage space.

Spacious SUVs with extra leg room (carriers/Non-carriers for extra luggage)

1-6 passengers

Empowering you every day

Whether you are travelling alone or with friends and family, choose from our extensive fleet to drive you safely wherever you want to go.

Drive your business forward

Reliable rides for every meeting

Escape the ordinary

Your perfect weekend getaway awaits

Cherish every moment

Seamless travel for special occasions

Frequently asked questions

Got questions? We've already got answers. It's like we can hear you thinking.

How much in advance can I book an outstation ride?

You can book your Ola Outstation ride as early as 7 days before or as soon as 15 minutes before you need to leave.

What additional charges are applicable on my Outstation ride?

Additional fares & charges will be applicable on your outstation fare in case you exceed the trip duration or number of kms from the base kms. You will be charged additional km fare and/or extra hour charge as applicable.

Note: State taxes, Permits, Tolls or Parking Fee are charged extra. These (if applicable) are not included in your estimated fare. You will need to pay for the same during the trip in cash. Please collect receipts for all the tolls and permits paid and pay only the amount as charged by the government authorities.

What is Ola Outstation?

Travelling to a nearby city? Get a comfortable and affordable ride. Open the Ola app, and select the Outstation icon to get going!. Depending on your travel requirements, you can choose a car category from Mini, Sedan Prime or SUV for your trip.

How do I book an Outstation ride?

Download our App or book through the website links.

What are start and end trip OTPs?

Start trip OTP: The start trip OTP will be shared with you via SMS on your registered phone number. You can also find this OTP on the Track Ride screen of your Ola app. Once you board your Ola Outstation ride, your driver will press the start trip option on his app. Share the OTP with the driver after checking the odometer reading entered by the driver.

Note - Please don’t share the start OTP with the driver until you have boarded the cab.

Stop trip OTP: To end your Outstation trip, you will need to share the stop trip OTP with your driver.. The stop trip OTP will be shared with you via SMS on your registered phone number. You can also find this OTP on the Track Ride screen after your trip has started.

What is odometer reading?

The actual distance (kms) travelled on your Outstation ride is calculated using the odometer reading entered by the driver at the start and end of the trip. Your driver will be able to enter the odometer only after you have shared Start/Stop trip OTP with him.

Please check the odometer readings being entered by the driver to start and end the trip for accurate billing. You will also receive the odometer reading details via SMS for your reference at the start and end of the trip.

How do I pay for my outstation ride?

You can opt to pay for your Outstation ride via Ola Money, Card, UPI or Cash. You can Pick your preferred payment option before you confirm the booking.

How do I cancel my Outstation ride?

Ola Outstation offers you the benefit of free cancellation until you have received the driver details. You will be charged cancellation fee only if you cancel the ride 5 minutes after receiving the driver details.

If a driver cancels the booking, your trip will be re-allotted to another cab. If you are cancelling the booking due to ‘driver denied duty', ‘unable to contact the driver’ or ‘cab is not moving in my direction’, you will receive a notification on the app screen asking if you need another cab. Press ‘Find a ride’ and another cab will be allotted to you.

Download the Ola app

Book cabs, buy insurance, access Ola Money and much more. Available for iOS and Android devices.

Scan QR code to download

Our popular routes

Any one have idea to download the buying receipt of buying ola bikes

Any one know any idea about download buying receipt of my ola bike.

Go to Ola Cabs app > in order page select you order>in bottom of the page>view invoice/receipt . If the download option not available on the invoice, email ola support about this.

Mail cust care they will furnish the same

IMAGES

VIDEO

COMMENTS

Support for your bookings and other related issues. Login . My Account Fares, Charges & Transaction FAQs Ola Money Safety All About Ola Services A Guide to Ola Covid 19 ONDC Foods Grievance & Nodal Officer

Name Data Type Description Type Remark; crn: string: CRN of a corporate ride: query: Mandatory

This invoice is issued on behalf of Transport Service Provider. 2. This is an electronically generated invoice and does not require a digital signature. ... There are various circumstances under which individuals may qualify for reimbursement of cab expenses: Corporate Travel Policies ... Ola, and Meru offer on-demand cab services through ...

This Video is about how you can mail your OLA trip's invoice through OLA mobile app easily.Subscribe: http://bit.ly/sksharesAbout Channel: We share some How ...

Taxi drivers can use the ola taxi service invoice to furnish their clients with a bill for services rendered. The invoice can provide the itemised service times and hourly rates for taxi services. ... Invoices are proof of travel; that's why a passenger must take an ola taxi bill while travelling. You need to ask for a receipt when taking an ...

Across India, Australia, New Zealand and the UK. 55 Cr+. 55 Crore+ yearly rides. Yearly rides. Booked by our customers every year. 12 Cr+. 12 crore+ km on S1. Kilometers on S1. Distance covered on Ola S1 scooters within a year of launch.

OlaFareFinder calculates the cost of your Ola ride in over 100 supported cities. Simply enter your pickup and dropoff locations to get the price estimate of a variety of Ola Cab services (Ola Mini, Ola Sedan, Ola Prime, etc) available in your area. Check Ola peak time surcharge pricing! OlaFareFinder will even warn you if peak time pricing is ...

For best taxi service @lowest fares, say Ola! | olacabs.com. Now book city taxi, share, rental and outstation directly from web. India's smartest cab service. Book a cab in Lucknow, Indore, Mumbai, Pune, Bangalore, Delhi , Chandigarh, Ahmedabad, Chennai, Hyderabad with one-touch on the ola mobile app or call 33553355.

At Ola, we're always thinking of your convenience which is why we're including the cost of the toll in your Ola invoice. So every ride, be it to/from the airport, or anywhere else along the way, is truly cash-free. No more reaching for your wallet or hunting for change at the toll booth! Simply sail on by and pay the amount when you are ...

Quick steps to complete and eSign Ola cab bill generator online: Use Get Form or simply click on the template preview to open it in the editor. Start completing the fillable fields and carefully type in required information. Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

Here's how it works: Step 1. Book a ride and select your Card/UPI account as the payment option. Step 2. Click on "Pay Now" after the ride starts. Step 3. Enter CVV and OTP to authorize the payment. Step 4. You're done!

Point-to-Point travel. Convenient city travel option with Ola for Business. Executive Travel. Book comfortable rides with Ola for executives right from our corporate dashboard. Employee Pickup and Drop. Hassle-free daily commute for employees with Ola. Employee Perks. Night drops, weekend work travels, easy travel allowance options - we cover ...

Ola ride invoice download kaise kare | ola Cab bill download | how to download ola cab bill receipt_____Tech inventedThanks...

Quick Start Guide. White Papers. Blogs. Contact Us. Docs. Help. Now use Ola for managing your Corporate Travel. Its Easy, Safe and Efficient.

OLA's business model. OLA is an online marketplace for drivers. These drivers are independent and they are either self-employed (own their commercial vehicles), or work for an Operator who owns multiple cars. Like you have an OLA app on your smart phone to book a cab, these drivers have a similar Driver mobile App on their smart phones.

Commission Invoice by Ola to Reliance: Trip charges 1,000 GST @ 5% 50 Total 1,050 Ola will pay 1,000 to M/s. Akash cars and pay GST to the government. ... Ola & Uber, cab aggregators are providing leasing of car services to its drivers. Cab aggregator buys a car and gives it to the driver on lease to use it for transportation of passengers on ...

Start trip OTP: The start trip OTP will be shared with you via SMS on your registered phone number. You can also find this OTP on the Track Ride screen of your Ola app. Once you board your Ola Outstation ride, your driver will press the start trip option on his app. Share the OTP with the driver after checking the odometer reading entered by ...

Go to Ola Cabs app > in order page select you order>in bottom of the page>view invoice/receipt . If the download option not available on the invoice, email ola support about this. 2 Likes. harshal11 September 2, 2023, 1:28pm 3. Mail cust care they will furnish the same ...

An option for business travelers, Ola Corporate can be accessed through the regular Ola cabs app. Once authenticated by their employer, executives simply need to activate their corporate profile to book corporate rides right from the app. Ola strives to make travel safe for all its users by providing professional drivers with background ...