- Reward types, points & expiry

- What card do I use for…

- Current Credit Card Sign Up Bonuses

- Credit Card Lounge Benefits

- Credit Card Airport Limo Benefits

- Credit Card Reviews

- Points Transfer Partners

- Singapore Airlines First & Business Class Seat Guide

- Singapore Airlines Book The Cook Wiki

- Singapore Airlines Wi-Fi guide

- The Milelion’s KrisFlyer Guide

- What is the value of a mile?

- Best Rate Guarantees (BRGs) for beginners

- Singapore Staycation Guide

- Trip Report Index

- Credit Cards

- For Great Justice

- General Travel

- Other Loyalty Programs

- Trip Reports

Extended: Earn 4 mpd on travel insurance policies with SingSaver

From now till 1 July 2024, buy travel insurance policies with AIG, FWD, MSIG, Singlife and more through SingSaver and earn 4 mpd.

Last month, SingSaver ran a campaign which offered 4 miles per dollar on travel insurance purchases, as well as a 100,000 KrisFlyer miles giveaway.

The giveaway has since closed to entries, but the 4 mpd has been renewed till 1 July 2024, with a different list of participating policies this time round.

If you’re thinking of buying a single trip or annual plan, this is a great opportunity to pick up some bonus miles in the process, since almost all banks now exclude rewards for insurance.

Earn 4 mpd on travel insurance purchases

From 7 May 2024, 2024, 9 a.m to 1 July 2024, 8.59 a.m, purchases of selected travel insurance products via SingSaver will earn a total of 4 KrisFlyer miles per S$1.

The following products are participating:

- AIG Insurance (Single Trip & Annual Trip)

- FWD Insurance (Single Trip & Annual Trip)

- Great Eastern Travel Smart (Single Trip & Annual Trip)

- MSIG Insurance (Single Trip & Annual Trip)

- Singlife Insurance (Single Trip & Annual Trip)

- Seedly Travel Insurance (Single Trip)

- Starr Insurance Singapore (Single Trip & Annual Trip)

All premiums will be rounded down to the nearest S$1 before miles are awarded; for example a S$200.80 policy will earn 800 miles.

KrisFlyer miles earned under this offer will be deposited directly to your KrisFlyer account by 30 August 2024.

Terms & Conditions

The T&Cs for this campaign are split into two sets, but they both apply concurrently (i.e. each set of T&Cs mentions an earn rate of 2 mpd for a total of 4 mpd).

What credit card should you use to pay?

Unfortunately, the vast majority of credit cards now exclude rewards for insurance purchases. What few remain offer mediocre earn rates ranging from 0.24 to 1.2 mpd.

If you’re a Citi cardholder, however, you could use insurance premiums to help you meet the minimum spend for welcome offers or card benefits (e.g. limo rides with the Citi Prestige ). Even though these transactions don’t earn any points, Citi has confirmed they will still count towards the minimum spend.

From now till 1 July 2024, SingSaver is offering 4 mpd on travel insurance purchases, so be sure to browse the selection and see what works for you. My preferred option is Singlife because they cover the loss of miles and points, and have a “cancel for any reason” clause that you can invoke a maximum of once per policy/policy year.

There really aren’t a lot of options left for earning miles on insurance, so this is a rare opportunity.

- credit cards

- travel insurance

Similar Articles

Citi premiermiles card: more miles for fcy spend, enhanced welcome offer, and 5 million citi miles giveaway, roundup: credit card sign-up bonuses (september 2024).

The T&C states it ends on 7th May instead of 2nd May FYI.

CREDIT CARD SIGN UP BONUSES

Featured Deals

© Copyright 2024 The Milelion All Rights Reserved | Web Design by Enchant.sg

To offer you a better experience, this site uses cookies. Read more about cookies in our Privacy Policy .

- Register for SAFRA membership

- Login to my SAFRA membership

- SAFRA Choa Chu Kang

- SAFRA Mt Faber

- SAFRA Jurong

- SAFRA Punggol

- SAFRA Tampines

- SAFRA Toa Payoh

- SAFRA Yishun

- SAFRA@29 Carpenter Street

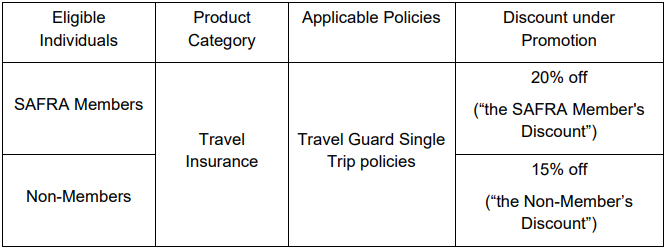

Travel Guard Plan

JOIN SAFRA NOW

AIG Travel Guard®

ALL SAFRA Members can now enjoy 20% off with purchase of any Single Trip plan!

Special features of Travel Guard plans:

- Now with COVID-19 cover

- 24/7 worldwide assistance services just a call away at +65 6733 2552

- Cover losses arising directly from act of terrorism during the trip

- Cover for leisure sports

- Unlimited emergency medical evacuation

Click on the link below to enjoy this exclusive promotion.

- Members (20% off): Click here!

- Non-Members (15% off): Click here!

*Please note that you will be directed to external websites hosted by AIG which are not managed by SAFRA. Note that you are solely responsible for the personal data that you provide and your personal data shall be subject to their personal data policies.

Common Questions

Will my medical expenses be covered if I fall sick during my trip?

Yes, Travel Guard plans cover medical expenses incurred overseas, up to S$2,500,000 depending on the plan type purchased.

Will my medical expenses be covered if I visit a doctor only when I return to Singapore?

Yes, Travel Guard plans cover post-trip medical expenses incurred in Singapore. You are required to seek medical treatment in Singapore within 48 hours upon your arrival in Singapore. After which, you will have up to a maximum of 30 days to continue medical treatment in Singapore.

Does Travel Guard cover my cruise?

Yes, Travel Guard provides coverage whether you are travelling by cruise, plane, train or automobile.

COVID-19 FAQ

Product Brochure

Policy Wording

Important Notes:

AIG's Travel Guard® is underwritten by AIG Asia Pacific Insurance Pte. Ltd. (AIG). SAFRA does not hold itself out to be an insurer, insurance broker or insurance agent. Please refer to the Policy for the specific terms, conditions and exclusions of this Plan. No insurance is in force until the Proposal Form is accepted by AIG in accordance with the Policy terms and conditions. AIG’s Travel Guard policies are protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for these Policies is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites ( www.aig.sg , www.gia.org.sg or www.sdic.org.sg ).

Credit Cards

- Best Rewards Credit Cards

- Best Credit Card Promotions

- Best Credit Cards for Dining

- Best Credit Cards for Shopping

- Best Cashback Credit Cards

- Best Miles Credit Cards for Travel

- Best No Annual Fee Credit Cards

- Best Credit Cards for Petrol

- Best Credit Cards for Businesses/SMEs

- Best Personal Loans

- Best Home Mortgage Loans

- Best Renovation Loans

- Best Car Loans

- Best Education Loans

- Best Debt Consolidation Loans

- Best Business/SME Loans

- Best Car Insurance

- Best Travel Insurance

- Best Home Insurance

- Best Mortgage Insurance

- Best Health Insurance

- Best Endowment Insurance

- Best Critical Illness Insurance

- Best Maid Insurance

- Best Whole Life Insurance

- Best Term Life Insurance

- Best Personal Accident Insurance

- Best Motorcycle Insurance

- Best Pet Insurance

Investments

- Best Online Brokerages

- Best Robo Advisors

- Best P2P/Crowdfunding Platforms

Bank Accounts

- Best Savings Accounts

- Best Fixed Deposit Accounts

- Best Debit Cards

- Best Hotel Booking Sites

- Best Wire Transfers

- Best Electrical Retailers

- Best Travel Deals

Personal Finance Guides

We'll help you make informed decisions on everything from choosing a job to saving on your family activities.

- Average Cost of Home Renovation

- Average Cost of Monthly SP Bills

- Average Cost of Domestic Help

- Average Cost of Moving Your Home

- Average Cost of Renting a Car

- Average Cost of a Wedding

- Average Cost of a Divorce

- Average Cost of a Funeral

- Average Cost of an Engagement Ring

- Research Reports

- Evaluation Methodology

- AIG Travel Insurance: Is It Worth Your Money?

- Great golf and sports equipment benefits

- Above average baggage loss and delay benefits

- Can be pricey

- Not the best value plans on the market

AIG is one of the biggest and best-known insurers in Singapore. Reputation, however, does not always guarantee quality. Our team at ValueChampion is dedicated to providing objective analysis of the travel insurance market in Singapore to ensure that you are armed with the information you need to make educated decisions regarding your personal finances. Below, we evaluate the value of AIG's three travel insurance plans, bringing to bear in-depth knowledge of the Singapore insurance market to inform our review.

AIG Travel Insurance Details

Table of Contents

AIG Travel Insurance: What You Need to Know

Sports coverage, claims information.

- Summary of Coverage and Benefits

AIG offers three travel insurance policies: the basic "Standard" plan, the mid-tier "Superior" plan and the premium "Supreme" plan. Our study of dozens of travel insurance plans in Singapore found that each of these plans tend to be the most expensive on the market, occasionally challenged only by Chubb's plans for title of "priciest." It would be one thing if AIG's travel insurance plans coupled their high prices with market-beating coverage, however, we found that at best, these plans offer only average coverage. Most of their unique coverage and benefits are for the Enhanced and Supreme plans only, as is the option to purchase annual plans.

Of the three, the entry-level Standard Plan offers the least value for your money, providing substantially less coverage in many important areas like medical expenses and trip inconvenience than high-value standouts like the Allianz Global Assistance Bronze Plan while costing significantly more for all kinds of trips to all destinations. Furthermore, AIG fails to include an option for annual/multi-trip policies for its Standard Plan, making it difficult for budget travellers who take more than 3 to 5 trips out of Singapore a year to find an economical solution for their travel insurance needs.

Better value can also be found among other alternatives to AIG's mid-tier and premium-tier plans, the Superior and Supreme plans. Allianz Global Assistance's Silver and Gold, as well as Aviva's Travel Plus and Travel Prestige, both offer great coverage for much lower prices than AIG's plans and would be a better choice in terms of coverage even if money was no object. And while golfers and sports enthusiasts may be slightly mollified to learn that AIG's Superior and Supreme plans do cover sports and golf equipment along with some other golf-related benefits, Aviva and American Express tend to offer similar or better coverage for less.

Notable Exclusions

AIG has standard exclusions including extreme sports (potholing, hunting trips, expeditions and ocean yachting, snowboard tricks), pre-existing medical conditions, travelling against the advise of your doctor, illegal acts, war and pre-existing medical conditions (unless its concerning repatriation of mortal remains or funeral expenses). The table below summarises some of AIG's common exclusions.

AIG includes coverage for golf and sport equipment if you purchase either their Supreme or Enhanced plans. The maximum coverage per item is S$500. You can also participate in any sport that is accessible to the general public and does not pose serious health risks.

AIG has a fairly straightforward claims process. To file a claim, you can either call their claims hotline or submit your claim and all of your supporting documents online.

Summary of AIG Travel Insurance Coverage and Benefits

We hope this review has helped you decide if AIG offers a travel insurance plan that will meet your needs. Below, you will find a table summarising AIG's premiums and coverage, as well as how it compares to the industry's averages. If you're interested in learning more about other alternatives on the market, we have compiled a guide to our picks of the best travel insurance in Singapore.

- Best Travel Insurance in Singapore

- Average Costs and Benefits of Travel Insurance

- How to Pick the Best Travel Insurance

Anastassia is a Senior Research Analyst at ValueChampion Singapore, evaluating insurance products for consumers based on quantitative and qualitative financial analysis. She holds degrees in Economics and International Business Management and her prior working experience includes work in the capital markets sector. Her analyses surrounding insurance, healthcare, international affairs and personal finance has been featured on AsiaOne, Business Insider, DW, Vice, Her World, Asia Insurance Review, the Australian Institute of International Affairs and more.

Our Top Travel Insurance

- Best Travel Insurance Promotions

- Best Annual Travel Insurance

- Best Travel Insurance for Sports

- Best Travel Insurance for Families & Groups

- Best Travel Insurance for Seniors

- Best Insurance Companies in Singapore

Keep up with our news and analysis.

Stay up to date.

Featured Travel Insurance Companies

- Allianz Travel Insurance

- FWD Travel Insurance

- Direct Asia Travel Insurance

- Etiqa Travel Insurance

- Aviva Travel Insurance

- HL Assurance Travel Insurance

- Wise Traveller Travel Insurance

Travel Insurance Basics

- What is Travel Insurance

- Why You Need Travel Insurance

- Average Cost and Benefits of Travel Insurance

- Average Cost of a Staycation

- Average Cost of a Vacation

- Who Should Get Annual Travel Insurance

- Airline Travel Insurance vs. Traditional Travel Insurance

- Travel Insurance and Terrorism Coverage

- Travel Insurance and Haze Coverage

- Travel Insurance and Zika Coverage

- Travel Insurance and Overbooked Flight Coverage

- Travel Insurance and Trip Cancellation Coverage

- How to Successfully File an Insurance Claim

Other Financial Products for Travellers

- Best Air Miles Credit Cards

- Best Credit Cards for Complimentary Lounge Access

- Best Credit Cards for Overseas Spending

Related Articles

- Best Year-End Travel Destinations to Beat the Crowd

- Travel Diaries: 5 Safest Travel Destinations in the World

- Travel Essentials Checklist For Your Family Vacation

- How To Survive and Thrive as a Solo Traveller

- How Travel Insurance Can Protect Your Refund Rights for Flight Cancellations and Delays

- Travel Essentials for Every Trip – From the Best Travel Insurance to Miles Credit Card

- Best Frequent Flyer Plans to Upgrade Your Travels in 2023

- Travel Insurance

- Copyright © 2024 ValueChampion

Advertiser Disclosure: ValueChampion is a free source of information and tools for consumers. Our site may not feature every company or financial product available on the market. However, the guides and tools we create are based on objective and independent analysis so that they can help everyone make financial decisions with confidence. Some of the offers that appear on this website are from companies which ValueChampion receives compensation. This compensation may impact how and where offers appear on this site (including, for example, the order in which they appear). However, this does not affect our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services

We strive to have the most current information on our site, but consumers should inquire with the relevant financial institution if they have any questions, including eligibility to buy financial products. ValueChampion is not to be construed as in any way engaging or being involved in the distribution or sale of any financial product or assuming any risk or undertaking any liability in respect of any financial product. The site does not review or include all companies or all available products.

MoneySmart Financial is an Exempt Financial Adviser and Registered Insurance Broker licensed by Monetary Authority of Singapore ("MAS").

AIG Travel Guard® Direct - Supreme

Looking for Rewards? You Came to the Right Place.

Sign up for free to explore our selection of gifts and claim yours today..

By continuing I agree to MoneySmart.sg’s Terms of Use and Privacy Policy

Already have an account? Login

[GIVEAWAY | Receive your cash as fast as 30 days*] Get over S$105 worth of rewards: • Includes S$30 Trip.com Hotel Coupon and Eskimo Global 1GB eSIM (worth S$9.50) with every policy purchased . • Plus, get up to S$40 via PayNow and S$30 Revolut cash reward with eligible premiums spent . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Are you eligible?

MoneySmart Exclusive: Promotion is valid from 01-September-2024 to 30-September-2024

Revolut Giveaway: Promotion is valid from 01-September-2024 to 30-September-2024

Customers need to apply through MoneySmart to be eligible.

Customers need to submit the MoneySmart Claim Form by 1st October 2024 to be eligible.

This promotion is only valid for AIG Travel Guard Direct Single Trip Travel Insurance plans

What you need to know

Receive S$30 Trip.com Hotel Coupon and an Eskimo Global 1GB eSIM as fast as 2 working days* with every policy purchased. No min. spend required. T&Cs apply.

In order to qualify for your rewards: a. Minimum premium of S$50 after any AIG discount i. S$5 Cash via PayNow and S$30 Revolut cash reward

b. Minimum premium of S$100 after any AIG discount i. S$20 Cash via PayNow and S$30 Revolut cash reward

c. Minimum premium of S$150 after any AIG discount i. S$40 Cash via PayNow and S$30 Revolut cash reward

[Giveaway] Score S$100 Revolut cash reward in our giveaway with every travel insurance policy purchased (no min. spend) when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

*Faster cash redemption will be sent as fast as 1 month from 30 th September 2024

At times, you may need to make a claim under your insurance policy. Fret not, that's what insurance is for. Simply make your claim through AIG's Claims Page here .

All Details

Key features.

Voted TripZilla's Best Travel Insurance (Single Trip).

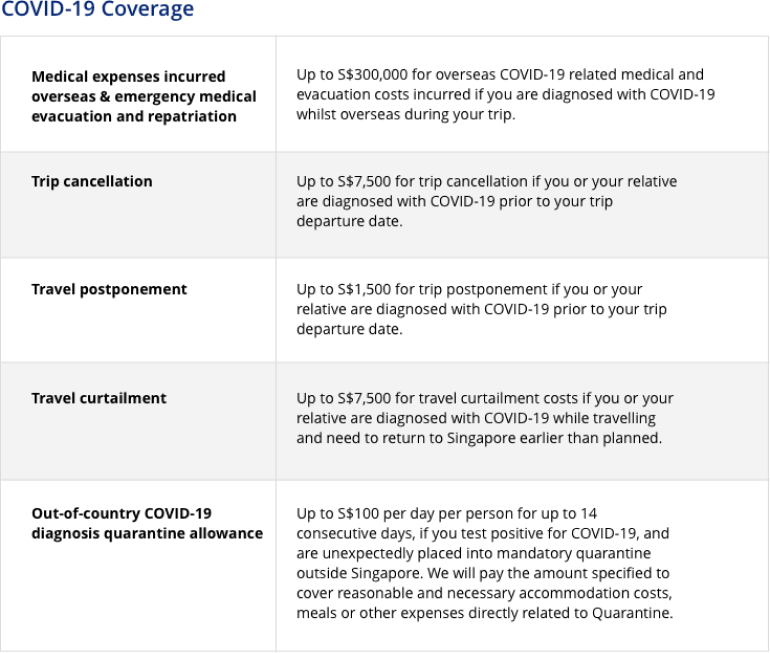

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

Covid-19 Protection

Travel inconvenience, medical coverage, personal protection, leisure activities, other coverage protection, plan materials, product documents, moneysmart promotions, coverage preference.

Disclaimer: At MoneySmart.sg, we strive to keep our information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products and services are presented without warranty. Additionally, this site may be compensated through third party advertisers. However, the results of our comparison tools which are not marked as sponsored are always based on objective analysis first.

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

Log in to pay bills, manage policies, view documents, company news, materials & more.

Individuals

Private client group.

Policyholders in the U.S. can make online payments.

Workers’ Compensation (AIG Go WC)

Access workers’ compensation claims information, including FAQs, payments, prescription data, doctor information, and more.

Report a Claim

Report Aerospace, Commercial Auto, General Liability, Property, and Workers’ Compensation claims.

Dental, Group Life, and AD&D Claims

Employers and employees can access claim forms, claim reports, and information on claim status.

IntelliRisk Advanced

Clients and brokers can file claims, manage risks, and access claims data from 100+ countries.

myAIG Client Portal for Multinational

Track the status of controlled master programs, view policy details, download policy documents, access invoices, and more.

AIG Multinational Insurance Fundamentals

Receive free, accredited online training in multinational risk assessment and program design.

Brokers & Agents

Myaig portal for north america.

Generate loss runs, download policy documents, access applications and tools, and more.

myAIG Portal for Multinational

U.s. producer appointment and licensing.

Submit requests to become an AIG appointed brokerage/agent, expand or terminate your current AIG appointment.

Risk Managers

Log in to pay bills, manage policies, view documents, company news, materials & more.

- INDIVIDUALS

- BROKERS & AGENTS

- RISK MANAGERS

AIG Travel Guard

Get a quote in less than two minutes and travel with more peace of mind.

Travel Guard Plans

Compare coverage levels and pricing on our most popular plans with our product comparison tool—and find a Travel Guard plan that’s right for you.

Deluxe Plan

Our top-of-the-line, comprehensive travel coverage that sets the standard.

Preferred Plan

A comprehensive travel plan with superb coverage and service from start to finish.

Essential Plan

Savvy coverage for the budget-minded traveler.

Pack N' Go Plan

Immediate coverage for unplanned trips and adventures

Annual Travel Insurance Plan

Year-round coverage for your travel investments.

Millions of travelers each year trust AIG's Travel Guard to cover their vacations

Travel insurance plans provide coverage for certain costs and losses associated with traveling. Travel Guard ® helps you navigate canceled flights, lost bags, sudden health emergencies, and much more—almost anywhere in the world. Whether you’re planning a two-day getaway, a cruise, an adventure vacation, or a month-long international holiday, our plans help cover travelers and their trip inverstments.

Education Center

Sort through common questions about travel insurance

Traveler Resources

Safety information and travel tips for travelers

Preparing travelers wherever their journey takes them

AIG Travel CEO Jeff Rutledge shares how the underlying risks of travel have changed and what AIG is doing to help companies and individuals manage risks.

Coverage available to residents of U.S. states and the District of Columbia only. These plans provide insurance coverage that only applies during the covered trip. You may have coverage from other sources that provides you with similar benefits but may be subject to different restrictions depending upon your other coverages. You may wish to compare the terms of each policy with your existing life, health, home, and automobile insurance policies, as well as any other coverage which you may already have or is available to you, including through other insurers, as a member of an organization, or through your credit card program(s). If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc .(Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP.

This is only a brief description of the coverage(s) available. The policy will contain reductions, limitations, exclusions and termination provisions. Insurance underwritten by National Union Fire Insurance Company of Pittsburgh, Pa., a Pennsylvania insurance company, with its principal place of business at 1271 Ave of the Americas, Floor 41, New York, NY, 10020-1304. It is currently authorized to transact business in all states and the District of Columbia. NAIC No. 19445. Coverage may not be available in all states.

Related Content

COVID-19 Updates

AIG Women’s Open 2024

Corporate Accident & Health Insurance

DO NOT SELL OR SHARE MY PERSONAL INFORMATION

The California Consumer privacy Act gives California residents the right to opt-out of the sale or sharing of their personal information. A "sale" is the exchange of personal information for payment or other valuable consideration and includes certain advertising and anatytics practices. "Sharing" means the disclosure of personal information for behavioral advertising purposes, where the informatirm used to serve ads is collected across different online services.

Opt-out from the sale or sharing of your personal information.

Your request to opt out will be specific to the browser from which you submit your request, and you will need to submit another request from any other browser you use to accessour website. Additionally, if you clear cookies from your browser after submitting an opt-out request, you will clear the cookie that we used to honor your request. For this reason, you will have to submit a new opt-out request.

For information about our privacy practices, please review our Privacy Notice .

Thank you. We have received your request to opt out of the sale/sharing of personal information.

More information about our privacy practices.

Are you sure you want to log out of your account?

- Search for:

- Key Milestones

- General Committee

- Our Subsidiaries

- Membership Categories

- Constitution & Bye-laws

- Renew AA Membership

- Publications

- Traffic Conditions

- ERP Information

- Where To Park

- Motoring Tips

No products in the cart.

HOME • TRAVEL INSURANCE • TRAVEL GUARD

Travel Guard

TRAVEL GUARD Now with COVID-19 cover

Travel Guard is now enhanced with COVID-19 coverage. Better coverage, same great service and experience. As you look forward to travelling again, you can travel confidently with AIG’s Travel Guard for your next getaway. Our wholly owned assistance centers are equipped to assist you 24 hours a day, 7 days a week.

Enjoy world-class travel protection with worldwide coverage

AIG’s Travel Guard helps keep unexpected problems off your itinerary with 24/7 worldwide assistance. From minor inconveniences to major emergencies, we are prepared for what may go wrong, so you can enjoy your holiday.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

AA Travel Insurances

AA Tourcare Plus

TM Xplora Plus

AA Student Assist

AA Overseas Student

Enhanced AA AutoPlan

AA Senior Motor Plus

AA Motor 365

AA Motor Plus

Commercial Insurance

Speak To Us To Find Out More

Contact us at the following

Save 10% More as AA Member

Sign in to your account using Membership ID or email and password.

Don't have an account? Sign up

Username or email address *

Password *

Remember me Log in

Lost your password?

Submit Your Motor Insurance Quote Request

Submit Quote

Travel Insurance Singapore Guide (2024): Must-Knows for Choosing the Best Travel Insurance

Travelling is a favourite Singaporean pastime. A national sport, if you will. But while we all love travel and wanderlust, most of us don’t give much thought to buying travel insurance .

Buying travel insurance in Singapore is something a lot of us take for granted. Few of us bother to buy travel insurance ahead of time, and even fewer compare policies to find the best travel insurance in Singapore .

Here is everything you should look out for before buying travel insurance in Singapore.

Key features to look out for in travel insurance

- What does travel insurance cover?

- How to choose travel insurance

- Travel insurance prices

- Best travel insurance in Singapore

- Common mistakes when buying travel insurance

- Travelling with pre-existing health conditions

- When should I buy travel insurance?

- Single trip or annual travel insurance?

- Compare travel insurance before buying

1. What does travel insurance cover you for?

A good travel insurance policy covers you for a whole series of situations, from the small inconveniences to the most terrible.

Trust me, you never want to be in a situation that you’re not covered for.

It could be a minor inconvenience, like having your luggage delayed and being forced to spend at least one night in the same clothes you wore on the entire flight. Or it could be a serious medical emergency, like getting stung badly by jellyfish in the middle of a remote island adventure and needing immediate medical attention.

These days, almost all travel insurance in Singapore automatically includes COVID-19 coverage. That means, you’ll be able to claim from your travel insurance if you get Covid-19 while travelling.

You should also have coverage for everything from lost and delayed luggage, flight delays and cancellations, all the way to medical treatment, medical evacuation and even repatriation in case of serious illness and death. All these different situations have different claim limits, of course.

Travel insurance also covers things like reimbursing deposits if your travel agent goes bust, if your credit card is used fraudulently overseas, or if you damage your rental car . Some policies even pay you if you are kidnapped while overseas! And the best part is that travel insurance is relatively cheap and convenient to buy.

Back to top

2. How to choose travel insurance

With so many different benefits in a travel insurance plan, it can be tough to decide if a particular travel insurance plan is worth your money. You should look out for how much you are reimbursed for common travel hiccups.

- Find a travel insurance that covers flight delays and cancellations: Flight delays happen more often than you realise. They can be extremely inconvenient, especially if it ends up causing you to miss your connecting flight. Ensure that your policy covers you for a decent period of time. For example, if your flight is delayed, some policies pay you $100 for every 6 consecutive hours of delay. There’s usually a cap of around $200-$500, but if you want more coverage DirectAsia Voyager 150 pays out up to $1,000 for travel delay.

Total Premium

DirectAsia Voyager 150

[GIVEAWAY | FLASH DEAL | Receive your cash as fast as 30 days*] • Enjoy 40% off your policy premium. Get up to S$55 worth of UPSIZED rewards: • Includes up to S$25 via PayNow and S$30 Revolut cash reward with eligible premiums spent . T&Cs apply. S$3,200 worth of gifts to be scored on top of existing rewards: • Samsonite Apinex 69/25 Luggage (worth S$600) when you are the 88th person to submit the MoneySmart Claim Form each week. T&Cs apply. • S$100 Revolut cash reward when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Key Features

Additional coverage for Travel Insurance - Sports equipment, Maid and COVID-19. Extreme Sports add-on only available for Annual Plans.

Kids go free – up to four kids travel for free with a Family policy only (2 adults)

Matching kids limits – children enjoy the same coverage limits as adults

Emergency Dental – Accidental Dental treatment can be costly, so it is covered under the main medical expenses coverage which is higher than a separate dental benefit

Optional COVID-19 coverage on trip cancellation, medical expense, and emergency evacuation. Only for Single Trip.

- Lost or delayed baggage: Make sure your policy covers you well for such situations. Many policies pay $100 for every 6 consecutive hours your baggage is delayed, including Bubblegum Travel Insurance which pays up to $3,000 for lost or damaged baggage. Don’t forget to also pay attention to the maximum amount you’re covered for.

Bubblegum Travel Insurance

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy 10% off your policy premium Get over S$90 worth of rewards: • Includes S$30 Revolut cash reward, S$30 Trip.com Hotel Coupon and Eskimo Global 1GB eSIM (worth S$9.50) with every policy purchased. • Plus, get up to S$25 via PayNow with eligible premiums spent . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Bubblegum offers just 1 affordable plan to suit all your travel needs to maximise your savings

Overseas medical expenses up to $150,000 SGD (Covid-19 sub-limit of $65,000 included)

24-Hour global Emergency Assistance services including Emergency Medical Evacuation and Repatriation

Covid-19 trip related cancellation/curtailment up to $600 SGD included

Adventurous activities like scuba diving and hot air ballooning are covered with no limit on depth or height.

- Medical coverage overseas: Since you can never predict what might happen on your trip, it literally pays to be safe than sorry. A good travel insurance policy covers you for at least $200,000 for overseas medical coverage and unlimited coverage for emergency medical evacuation and repatriation. One value-for-money insurance policy that fits the bill is Starr TraveLead Comprehensive Bronze .

- Travel insurance with COVID-19 coverage: Ideally, your policy should offer coverage for a range of COVID-19 expenses you might encounter during your travels (and even before you fly!). Look out for the travel insurance policies’ coverage for trip cancellation and postponement and medical expenses due to Covid-19. Overseas quarantine cash allowance is an added bonus. For example, AIG Travel Guard® Direct – Enhanced covers $100 per day for 14 days if you’re quarantined overseas due to COVID-19.

AIG Travel Guard® Direct - Enhanced

[GIVEAWAY | Receive your cash as fast as 30 days*] Get over S$105 worth of rewards: • Includes S$30 Trip.com Hotel Coupon and Eskimo Global 1GB eSIM (worth S$9.50) with every policy purchased . • Plus, get up to S$40 via PayNow and S$30 Revolut cash reward with eligible premiums spent . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

Voted TripZilla's Best Travel Insurance (Single Trip).

Up to S$250,000 in overseas COVID-19 related medical coverage if you are diagnosed with COVID-19 overseas.

Overseas quarantine allowance of up to S$100 per day per person for up to 14 days if you test positive for COVID-19 overseas and are unexpectedly placed into mandatory quarantine.

Up to S$1,500 if you are diagnosed with COVID-19 and have to postpone your trip.

Up to S$7,500 in curtailment costs if you are diagnosed with COVID-19 while travelling and need to return to Singapore earlier than planned.

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic and no further action is required from you. For more information on the types of benefits that are covered under the scheme as well as the limits of coverage, where applicable, please contact AIG Asia Pacific Insurance Pte. Ltd. or visit the AIG, GIA or SDIC websites (www.AIG.sg or www.gia.org.sg or www.sdic.org.sg).

Purchase your travel insurance with confidence and enjoy unlimited flexibility with AIG's Travel Guard® Direct

3. Travel insurance prices in Singapore

Travel insurance in Singapore is very price-sensitive, and sometimes insurers can compete to shave off even $1 from their premiums to make their policies more enticing (yay for us!).

One way to get a cheaper plan is to see which insurers offer regional travel insurance . If you are only travelling to Thailand, for example, it is usually cheaper to get a policy that covers only SEA or ASEAN countries, rather than a worldwide coverage policy .

However, price is not the only factor—especially since cheap insurance policies often mean significantly less coverage. Buying travel insurance is not like buying a “warehouse sale” LV bag in Chatuchak Market. You don’t just shop around, look for the stall owner with the weakest bargaining skills, and haggle the price down as low as can get.

Look at other aspects of the policy when buying travel insurance . There are many other factors to consider—for example, how much coverage you’re eligible for, and how quickly your claims can be processed. Make sure that you don’t have to wait till the next blue moon before you can see the results of your claims.

4. Which travel insurance to buy in Singapore?

Like anything else you purchase, the best travel insurance is what gives you the most value for money. Say you are only travelling to Thailand for a weekend shopping trip, for example. You’re probably travelling light and don’t need more than $3,000 coverage for loss of baggage, even if you can pay just $3 more for significantly more coverage. Save that $3 and treat yourself to all the Thai milk tea you can drink!

As we said earlier, you shouldn’t be so stingy and only buy the cheapest. The cheapest may have lots of terms and conditions when it comes to claims . For example, an insurer might not cover delayed luggage if it is only delayed returning to Singapore. If this is the only inconvenience you face in your entire trip, you might be understandably upset that it’s not claimable.

The important thing is to read the terms and conditions of your preferred policy carefully and make sure you’re not caught unawares. This is especially important when it comes to medical pre-existing conditions.

5. Common mistakes when buying travel insurance

How many of us actually know how to go about buying a good travel insurance that is suitable for our needs? Here are five common mistakes to avoid when buying travel insurance:

- Buying the most “convenient” travel insurance : Do you just buy the first travel insurance you see on Google? It is important to read the details of the coverage provided to see if they are adequate for your needs or to cover the risks of the destination you’re travelling to, eg. medical coverage and loss of personal belongings.

- Buying travel insurance at the last minute : Do you often buy your travel insurance when waiting to board your flight or while making your way to the airport? Yes, better late than never. However, you should be aware that some of the benefits of the travel insurance are applicable (eg. natural disasters , airline strike, tour agency bankruptcy) if you buy travel insurance ahead of your trip.

- Not buying travel insurance for the entire length of your trip : Should you purchase travel insurance only for the days you are actually overseas? No. You should include flights to and from your holiday destination. In the event of baggage delays, loss or damage, or overbooking of flights, you’d then be able to make a claim. For long haul trips, do remember to cater for the +1 or +2 days that it takes for your flight to reach Singapore.

- Not reading your travel insurance policy : Not all travel insurances are created equal. In fact, the policy document and terms of coverage makes for rather interesting reading. Do go through the policy document for what’s included and excluded, claim limits, and what you gotta do in order to make a claim.

- Assuming travel insurance is “one size fits all” : If your holiday includes adventurous elements like skydiving or scuba diving, check to ensure that the travel insurance you are considering covers these activities. MSIG TravelEasy Elite covers a whole range of activities, including sky diving, hot air ballon rides, and bungee jumping. Alternatively, check to ensure that adventurous activities are not excluded from the claims.

MSIG TravelEasy Elite

[GIVEAWAY | Receive your cash as fast as 30 days*] • Enjoy up to 40% off your policy premium. Get over S$110 worth of rewards: • Includes S$30 Revolut cash reward, S$30 Trip.com Hotel Coupon and Eskimo Global 1GB eSIM (worth S$9.50) with every policy purchased . • Plus, get up to S$45 via PayNow OR 1 x Apple AirTag (worth S$45.40) with eligible premiums spent . T&Cs apply. PLUS, score S$100 Revolut cash reward in our giveaway on top of existing rewards when you are the 8th and 88th person to sign up for a Revolut Account each week. T&Cs apply.

COVID-19 coverage of up to $300,000 medical cover and up to $5,000 travel inconvenience benefit for your trip protection.

Stay protected and enjoy a wide range of adventurous activities from sky diving, scuba diving, white-water rafting to winter sports like dog sledding, tobogganing, sledging and ice-skating.

Get covered across all TravelEasy Plan types with a high limit of S$1,000,000 for emergency medical evacuation & repatriation

MSIG provides cover for insolvency of licensed travel agencies registered with the Singapore Tourism Board (includes NATAS registered travel agencies)

6. Will pre-existing conditions affect my travel insurance?

One of the biggest travel insurance stories in 2017 was when a Singaporean man had a heart attack in Tokyo and fell into a coma. The medical costs alone cost $120,000 and bringing him back to Singapore via medical evacuation would cost another $120,000.

Because the man had been diagnosed with heart failure in 2012, his insurer considered it a pre-existing condition and therefore no claim was possible. Currently, one insurer that covers pre-existing conditions is MSIG TravelEasy Pre-Ex travel insurance.

MSIG TravelEasy Pre-Ex Standard

7. When should I buy travel insurance?

There are many, many things that can go wrong when you’re travelling. Half of these things could happen even before you leave the country!

Waiting to buy your travel insurance policy on the day you travel (or worse, after you’ve already crossed into international waters) puts you at risk for travel inconveniences big and small like delays or postponement.

A good travel insurance policy also covers you for your entire trip being cancelled unexpectedly.

You should buy a travel insurance online as soon as you’ve planned your trip. Getting your travel policy as early as possible does not make you “ kiasu ”. It makes you smart.

This is because you’ll want to maximise the coverage you can get from the policy. For example, if you haven’t bought a policy yet and the travel agency you’re booking with closes down a week before your travel, you won’t be able to claim anything. The same goes for flight delays and flight cancellations.

There is no penalty for buying travel insurance earlier, except maybe missing out on promotions that often happen around the travel season. But what’s the point of saving a few dollars and risk losing hundreds due to cancelled flights and hotel deposits?

8. Buy single trip or annual travel insurance?

In the past, it made more sense to buy single trip travel insurance plans when you leave Singapore. That’s because in the past, most people only travel once or twice a year. With the greater nomad and remote working culture … and travels over long weekend, though? It might actually be more convenient to buy an annual plan for your travel insurance.

A good gauge to determine whether to choose between a single trip plan and an annual plan is to ask yourself if you’re going to be travelling more than 3 times a year . And we’re not just talking about weekend getaways either!

Whether you’re just going across the Causeway or travelling further overseas for work, an annual plan definitely makes more sense to your wallet.

Depending on how often you travel and how far you travel, it might be worthwhile to consider buying annual travel insurance .

If you are a frequent traveller, you not only save money by buying an annual policy, but you’ll never have to spend time buying insurance every time you fly overseas. Of course, just like single trip travel insurance, you should still compare the various policies online before you commit.

Annual travel insurance has a flat premium and covers you for an entire year of travel. It usually costs about $200-$300 a year, so only buy it it you are a frequent traveller. That is, it only makes sense if you are going to travel overseas more than 7-8 times a year, at least.

9. Why should I compare travel insurance before buying it?

Comparing allows you to choose the best travel insurance policy for your needs. You’ll be able to see at a glance what coverage policies have for various situations, such as medical costs, and compensation levels for lost, delayed and damaged baggage.

But of course, comparing travel insurance in Singapore allows you to see that the cheapest travel insurance policy may not be the best. This is because the cheaper policies usually have significantly less coverage, naturally. While that may be a good thing for some travellers – there’s no need to get a $1,000 coverage for lost luggage if you’re only bringing the bare minimum to a staycation in Bangkok, for example.

ALSO READ: Best Travel Insurance in Singapore: AIG vs AXA vs FWD vs NTUC

Are you headed overseas? Compare the cheapest travel insurance here .

Related Articles

Comparing Digital Multi-Currency Accounts: Wise, YouTrip, Revolut, and More

10 Money Changers in Singapore with the Best Rates

10 Data Roaming Plans in Singapore—Which is Most Worth It? (2024)

9 Best Credit Cards in Singapore for Overseas Spending (2024)

How to Pay in China Like a Local: 2024 Guide for Foreigners and Tourists

JavaScript has been disabled on this browser. For a seamless experience, please enable the option to run JavaScript on this device

- Forms Centre

- Self-Service

Beware of phishing scams. For more information, please visit our Safety Tips page.

Travel Guard ® Direct FAQs

Covid-19 cover and benefits.

We have enhanced the Travel Guard Direct benefits to cover certain situations pertaining to COVID-19. Depending on the travel insurance plan purchased, the benefits and cover may differ. Full terms and conditions, as well as exclusions can be found here . For the latest travel requirements and advisories for arrival, transit or departure, please click here .

What are the key benefits of Travel Guard Direct’s COVID-19 coverage?

Travel Guard Direct offers COVID-19 coverage, depending on the type of plan purchased. A summary of the key benefits by plan types are listed below. Please refer to the policy wording for full details.

Return Per-Trip and Annual Multi-Trip policies

- Up to S$250,000 for medical expenses incurred overseas, emergency medical evacuation and repatriation

- Up to S$7,500 for travel cancellation or up to S$1,500 for travel postponement

- Up to S$7,500 for travel curtailment

- S$100 daily cash allowance for out-of-country COVID-19 diagnosis quarantine allowance, capped at 14 consecutive days

One-Way Per-Trip policies

- Up to S$7,500 for travel cancellation

- Up to S$1,500 for travel postponement

Do I need to be fully vaccinated to be eligible for Travel Guard Direct?

You do not need to be fully vaccinated to purchase Travel Guard Direct. However, do note that the country that you are travelling to (including any transit countries) may have specific prevailing entry requirements, including a requirement for you to be vaccinated before embarking on your trip. Please click here for relevant travel information regarding your travel destination(s). Please note also that Travel Guard Direct will not provide any cover if you are refused entry to any location because you do not meet the location’s entry requirements.

Is a COVID-19 swab test required before purchasing Travel Guard Direct?

You do not need to take a COVID-19 swab test to purchase Travel Guard Direct. However, the country that you are travelling to (including any transit countries) may have specific prevailing entry requirements, including a requirement for you to clear a swab test in order to travel. Please click here for relevant travel information regarding your travel destination(s). Please note also that Travel Guard Direct will not provide any cover if you are refused entry to any location because you do not meet the location’s entry requirements.

Can I choose to purchase Travel Guard Direct without the COVID-19 coverage?

Travel Guard Direct comes with COVID-19 coverage as part of the standard benefits for all plans.

What happens if I have a trip booked and the Singapore government or the destination country’s government closes borders due to COVID-19?

You will not be able to claim under your policy if the Singapore government or the destination country’s government closes the border at any stage before or during your trip. Please refer to the General Exclusions section in the policy wording for full details.

I travelled from Singapore to another country. If I test positive for COVID-19 upon returning to Singapore, will I be covered for medical expenses?

Travel Guard Direct’s COVID-19 coverage does not cover post-trip medical expenses regardless of whether medical treatment has been sought overseas during the trip.

Is there any coverage if I need to be quarantined upon arrival in Singapore?

Travel Guard Direct does not cover expenses related to quarantine in Singapore.

Does Travel Guard Direct cover me for expenses for COVID-19 diagnostic tests?

No, Travel Guard Direct does not cover expenses incurred for mandatory COVID-19 diagnostic tests for any pre-departure or post-departure testing requirements.

If I test positive for COVID-19 and need to cancel my trip before the departure from Singapore, can I claim for cancellation costs if the airline or travel company offers me a voucher or a credit note instead of a refund?

Travel Guard Direct does not cover trip cancellations or trip postponements if the airline, hotel, travel agent or any other provider of travel and/or accommodation has offered a voucher, credit note or re-booking of the trip as a form of refund or compensation for the cancellation.

If my trip is interrupted because I contracted COVID-19 whilst overseas and as a result I am placed under mandatory quarantine and cannot continue with the rest of my planned trip, can I claim for unutilized prepaid expenses or additional costs like changes in return transport and accommodation due to being placed under mandatory quarantine?

No, there is no cover for unutilized prepaid expenses for your planned trip or additional costs like changes in return transport and accommodation due to being placed under mandatory quarantine. However, subject to the terms and conditions of the policy you may be covered under the Out-of-country COVID-19 Diagnosis Quarantine Allowance benefit for S$100 per day up to 14 days if you are unexpectedly placed into mandatory quarantine outside Singapore because you test positive for COVID-19 while travelling.

If I contracted COVID-19 and am quarantined at a family members’ or friend's house overseas, can I claim for Out-of-country COVID-19 Diagnosis Quarantine Allowance?

Yes, we will pay S$100 per day for up to 14 consecutive days, if while overseas, you test positive for COVID-19 and as a result, are unexpectedly placed into mandatory quarantine outside Singapore, subject to the terms and conditions of the policy.

If I contracted COVID-19 and the country of travel does not require quarantine, can I claim Out-of-country COVID-19 Diagnosis Quarantine Allowance if I choose to self-quarantine?

No, the Out-of-country COVID-19 Diagnosis Quarantine Allowance will not apply if the quarantine is not mandatory.

Will the policy be automatically extended if I contracted COVID-19 overseas and need to be quarantined beyond my return date?

If at the time of the expiry of your policy, you are confined in a hospital and/or quarantined whilst overseas due to COVID-19 and you are following the directions of the attending medical practitioner, the hospitalisation or quarantine is covered by the policy if you are unable to return to Singapore as planned. The policy period will automatically extend for up to 30 days from the date of expiry of the policy without payment of any additional premium.

Please refer to the terms and conditions in the policy wording for full details.

If my travel companion is diagnosed with COVID-19 and as a result triggers automatic extension, will automatic extension be applied to my Travel Guard Direct policy as well?

Subject to the policy terms and conditions, automatic extension applies to one person who is insured with us and has been authorised by us in writing to extend and stay on the trip.

If I have purchased a family plan and one family member is diagnosed with COVID-19 and as a result triggers Automatic Extension, will the rest of the family members on the policy get Automatic Extension as well?

Yes, provided the conditions for automatic extension have been met for one person of the family, the other accompanying family members named in the Certificate of Insurance will have their coverage automatically extended under the same terms as well.

The travel companion whom I’m travelling with is diagnosed with COVID-19 before the departure date and is unable to proceed with the trip. Does Travel Guard Direct cover me for travel cancellation/travel postponement if I do not proceed with the trip?

Travel Guard Direct covers you for travel cancellation and travel postponement if your travel companion is diagnosed with COVID-19 prior to your trip departure date. Please refer to the respective benefits sections in the policy wording for full details of cover.

Can a self-administered Antigen Rapid Test (ART) result be used if I need to file for a claim due to COVID-19?

For COVID-19 benefits to apply, the COVID-19 diagnosis must be confirmed by a medical practitioner. A self-administered ART and/or photographic evidence of a positive ART result in itself would not substantiate a loss. A medical report from the medical practitioner to confirm the diagnosis will be required for claims assessment. Please click here for details on how to make a claim and the supporting documents required.

Other than COVID-19 diagnosis as confirmed by a medical practitioner, what other supporting documents are required to claim Out-of-country COVID-19 Diagnosis Quarantine Allowance?

The standard supporting documents are:

- COVID-19 diagnosis/result by a medical practitioner;

- Flight itinerary; and

- Government mandate detailing the period of quarantine.

Other Benefits Related Questions

What happens if i have a trip booked and the singapore government or the destination country’s government closes the borders.

You will not be able to claim under your policy if the Singapore government or the destination country’s government closes the border at any stage before or during your trip.

If I am sick overseas but did not receive treatment overseas, can I do so upon my return to Singapore?

If no medical treatment has been received overseas, the time limit for seeking medical treatment is up to a maximum of 30 consecutive days from your arrival in Singapore, provided you first seek medical treatment within 2 days of arrival in Singapore. Please refer to the terms and conditions in the policy wording for full details.

While overseas, I suffered an injury and sought treatment overseas. Does my Travel Guard Direct policy allow me to continue treatment after I am back in Singapore?

You have up to maximum of 30 consecutive days from your arrival in Singapore to seek follow-up treatment.

If I am pregnant, will I be covered for any medical treatment overseas?

We will reimburse for necessary and reasonable medical expenses incurred and paid by you overseas for pregnancy-related sickness you suffer during your trip.

Are business trips covered under Travel Guard Direct?

There are no exclusions for general business trips for Travel Guard Direct. Please refer to the terms and conditions in the policy wording for full details.

Does Travel Guard Direct cover existing health conditions?

We cover repatriation of mortal remains due to existing heath conditions. However, other benefits will not apply to any claim relating to existing health conditions.

Which countries are not covered under Travel Guard Direct?

Travel Guard Direct does not cover any loss, injury, damage or legal liability arising from travel in, to or through Cuba, Iran, Syria, North Korea, or the Crimea region.

Any sanction, prohibition, or restriction under United Nation resolutions or the trade or economic sanctions, laws, or regulations of the European Union or the United States of America will not be covered as well.

How does Travel Guard Direct define existing health conditions?

An existing health condition is defined as:

- first manifested itself, worsened, became acute or exhibited symptoms which would have caused an ordinarily prudent person to seek diagnosis, care or treatment;

- required taking prescribed drugs or medicine, or tests or further investigation had been recommended by a medical practitioner; or

- was treated by a medical practitioner or treatment had been recommended by a medical practitioner.

- any congenital, hereditary, chronic or ongoing condition of yours, your relative, business associate or travelling companion which you or they are aware of, or could reasonably be expected to be aware of, before the travel start date.

Is trekking covered under my Travel Guard Direct Policy?

There are no exclusions for trekking below 3,000 metres. For trekking above 3,000 metres and below 6,000 meters, the following conditions must be met:

- Trekking route must be available to general public without restriction;

- The trekking activity must be organised by a recognised commercial local tour / activity provider; and

- The entire trekking activity must be under the guidance, supervision of qualified guides and/or instructors and you must follow safety procedures and instruction of the guide and/or instructor at all times.

Please refer to the terms and conditions in the policy wording for full details.

How does automatic extension work?

We will automatically extend the period of insurance for up to 30 days from the policy expiry date without payment of any additional premium if, due to unexpected circumstances beyond your control, for example, due to injury or sickness or unavoidable delays affecting your return common carrier, you cannot complete your trip within the period of insurance stated in your Policy Schedule. This also applies to one person travelling with you who is authorised by us in writing to stay with you if the extension is due to medical reasons.

Who do I call in the event of an emergency during my travel?

Please contact our 24-hour emergency assistance hotline at +65 6733 2552.

Before you buy

Who can purchase travel guard direct and is there an age restriction.

You can purchase Travel Guard Direct if:

- you are ordinarily resident in Singapore (as defined under the Insurance Act 1966) with full rights to enter and return to Singapore regardless of medical status;

- you are returning to or intending to return to Singapore at the end of your travel; and

- your pre-trip arrangements must be made and paid for, and your trip must commence from Singapore.

Please note if you are above 70 years of age, the sum insured limit for some benefits including Overseas Medical Expenses and Personal Accident is lower. Please refer to the policy wording for full details

What is the maximum trip period under Travel Guard Direct for return per-trip and annual multi-trip plans?

The maximum trip period covered by Travel Guard Direct is up to:

- 182 days for return per-trip plans; or

- 90 days for any one trip under an annual multi-trip plan.

What is the difference between a per-trip policy and an annual multi-trip policy?

A per-trip policy covers from the time you depart Singapore and ceases upon your arrival in Singapore or the policy end date, whichever comes first. The maximum period of coverage for an overseas trip is 182 consecutive days. An annual multi-trip policy covers unlimited number of overseas trips, for up to 90 consecutive days each, within the policy year.

What zone do I select if I am going on a cruise?

If you are travelling on a cruise, you must select the highest covered zone based on the furthest destination of your cruise. For example, if your cruise will be stopping at Bali (Region 1) and Maldives (Region 2), you must select Region 2 for Maldives as that is the furthest destination of your cruise.

How do I purchase Travel Guard Direct?

You can purchase Travel Guard Direct via our website . We accept payment by credit card (Mastercard or Visa).

After you purchase

I wish to make changes to my travel dates or destination for my per trip policy. what should i do.

You can change your travel dates or destination via AIG’s self-help online portal before the policy effective date.

Can I cancel my Travel Guard Direct policy and get my premium refunded?

Per-Trip policy : There will be no refund of premium once the policy is issued.

Annual Multi-Trip policy : If the policy is cancelled in the first nine months from the policy issue date, a short rate will apply except if there has been a claim against the policy. A short rate is an insurance premium which we charge if your coverage is less than one year. It is not pro-rated. There will be no refund if you cancel the policy more than nine months from the policy effective date.

Can I extend my Per-Trip policy during my overseas trip?

You may extend your policy provided you have not claimed against or are aware of any known losses or circumstances that might give rise to a loss under the policy. You must apply for the extension prior to the expiry date of your original policy, and the total period of coverage must not exceed 182 days.

You can apply for an extension of your original policy via our online form and completing the payment of the additional premium. You will be required to confirm your travel arrangements when you extend the policy. Approval for your application for extended cover is subject to our review. Additional terms and conditions may apply and we reserve the right to decline any extension application.

I have an annual multi-trip policy and I need to travel for more than 90 days for a trip. What can I do to extend coverage for this trip?

You can apply for an extension for this trip by submitting a request via our contact us form . However, the total number of days for the trip must not exceed 182 days. You will be required to confirm your travel arrangements when you extend the policy. We will review your application for an extension before deciding whether or not to approve it. If we approve your application, additional terms, conditions and exclusions may apply.

How can I submit a claim?

Claims may be submitted online here .

IMAGES

VIDEO

COMMENTS

Promotion is valid till 30 September 2024. T&Cs apply. AIG Travel Assistance Services. Get 24/7 travel assistance exclusively to AIG policyholders. We operate globally across 8 service centres, ... This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). ...

Reliable and responsive claims. We pay S$30,000 in travel claims every working day. File online or call our claims hotline - our experts are ready to assist you. This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit Insurance Corporation (SDIC). Coverage for your policy is automatic ...

24/7 global assistance hotline. AIG Travel Insurance provides a 24/7 global assistance hotline staffed by multilingual operators based in Singapore who can provide assistance with medical emergencies and other travel-related issues. Should you require any emergency assistance, you may contact their 24/7 number at +65 6733 2552.

Best travel insurance in Singapore. ... AIG travel insurance (AIG Travel Guard Direct) $48 - $125: $100,000 - $2,500,000 ... Bubblegum travel insurance promotion. Total Premium. S$ 46.85. 10% Off Total Premium S$52.05. MoneySmart Exclusive. Most fuss-free plan. Bubblegum Travel Insurance.

Comparison of the Best Travel Insurance Promotions in Singapore. Single Trip: Enjoy a 25% discount when you use the promo code TRAVEL25 for Single Trip. Valid till 30 September 2024. T&Cs apply. Annual Trip: Use promo code ANNUAL25 to get 25% off Annual Trip plans when you buy now. Valid till 30 September 2024.

Compared to other travel insurance plans, AIG travel insurance's Covid-19 coverage is sorely lacking. Sompo's lowest tier Essential travel insurance plan, for example, offers $100,000 in overseas medical Covid-19 expenses, and another $100,000 for medical evacuation - so much more than the $50,000 in overseas medical expenses and ...

Promotion is valid from 22-August-2024 to 31-August-2024. Customers need to apply through MoneySmart to be eligible. Customers need to submit the MoneySmart Claim Form by. 1st September 2024. to be eligible. This promotion is. only valid for AIG Travel Guard Direct. Single Trip. Travel Insurance plans.

Call +65 6224 3698 to get answers, updates and help in settling your claim. AIG's Travel Guard Emergency Assistance Hotline is serviced by AIG Travel Asia Pacific Pte Ltd (ATAP). ATAP is AIG's wholly owned Travel Assistance Company comprising a worldwide team of medical professionals and insurance specialists providing advice and emergency ...

AIG Travel Insurance Plans. AIG is the world's largest insurance organisations, with more than 88 million customers. AIG is present in more than 90 countries and is listed on the New York Stock Exchange. In Singapore, AIG operates through AIG Asia Pacific. It's immediate and ultimate parents are AIG APAC Holdings Pte. Ltd. (incorporated in ...

AIG Travel Guard® Direct - Supreme. Up to 20% off with code SS20OFF. Lowest price in Singapore. S$ 61.60. S$ 77.0020% off. 24/7 travel assistance. Comprehensive Covid-19 coverage. Flexibility to alter policy for travel changes. High overseas medical expenses coverage.

From 7 May 2024, 2024, 9 a.m to 1 July 2024, 8.59 a.m, purchases of selected travel insurance products via SingSaver will earn a total of 4 KrisFlyer miles per S$1. The following products are participating: All premiums will be rounded down to the nearest S$1 before miles are awarded; for example a S$200.80 policy will earn 800 miles.

Yes, Travel Guard provides coverage whether you are travelling by cruise, plane, train or automobile. Downloads. COVID-19 FAQ. Product Brochure. Policy Wording. Important Notes: AIG's Travel Guard® is underwritten by AIG Asia Pacific Insurance Pte. Ltd. (AIG). SAFRA does not hold itself out to be an insurer, insurance broker or insurance agent.

AIG Travel Insurance: What You Need to Know. AIG offers three travel insurance policies: the basic "Standard" plan, the mid-tier "Superior" plan and the premium "Supreme" plan. Our study of dozens of travel insurance plans in Singapore found that each of these plans tend to be the most expensive on the market, occasionally challenged only by ...

We have enhanced the Travel Guard benefits to cover certain situations pertaining to COVID-19. Depending on the travel insurance plan purchased, the benefits and cover may differ. Full terms and conditions, as well as exclusions can be found here. For the latest travel requirements and advisories for arrival, transit or departure, please click ...

A comprehensive list of the current travel insurance promotions in Singapore - complimentary credit card travel insurance, promo codes and more. ... AIG Travel Insurance: $69: $169: AXA Travel Insurance: $138.72: $457.77: MSIG Travel Insurance: $117: $261: Singlife with Aviva Travel Insurance: $71.25:

Premium. S$ 69.30. S$77 10% off. Apply Now. Apply for AIG Travel Guard® Direct - Supreme travel insurance and get $2.5M for Med. Coverage (Overseas), $15K for Trip Cancellation and $10K for Loss/Damage of Baggage.

If you have any questions about your current coverage, call your insurer or insurance agent or broker. Coverage is offered by Travel Guard Group, Inc . (Travel Guard). California lic. no. 0B93606, 3300 Business Park Drive, Stevens Point, WI 54482, www.travelguard.com. CA DOI toll free number: 800-927-HELP. This is only a brief description of ...

AIG's Travel Guard helps keep unexpected problems off your itinerary with 24/7 worldwide assistance. From minor inconveniences to major emergencies, we are prepared for what may go wrong, so you can enjoy your holiday. This policy is protected under the Policy Owners' Protection Scheme which is administered by the Singapore Deposit ...

Set your mind at ease and be protected from the unexpected! In collaboration with AIG, you can now purchase AIG Travel Guard®* and enjoy 20% discount at Easybook.com. Special features of the Travel Insurance plan: Overseas medical expenses coverage up to S$2,500,000. 24-hr medical assistance. Unlimited emergency medical evacuation.

Ensure that your policy covers you for a decent period of time. For example, if your flight is delayed, some policies pay you $100 for every 6 consecutive hours of delay. There's usually a cap of around $200-$500, but if you want more coverage DirectAsia Voyager 150 pays out up to $1,000 for travel delay.

Greater and flexible coverage that allows you to change your travel dates for any reason. 24/7 Emergency travel assistance. Rental vehicle excess¹. S$1,500. Loss or damage of baggage & personal belongings². S$5,000. Accidental death & disability3. S$100,000. Overseas medical expenses4.

S$3,000 to S$7,500. Personal accident, accidental death or permanent disability. S$200,000 to S$400,000. With premiums starting from about S$260 for a multi-trip travel insurance plan, FWD travel insurance is one of the most affordable annual travel insurance plans you can find in Singapore, making it worthwhile to budget-conscious and frequent ...

Discover how I redeemed just 27,500 United MileagePlus miles for a luxury business-class flight on Singapore Airlines. Learn how you can maximize your miles and travel in style.

We have enhanced the Travel Guard Direct benefits to cover certain situations pertaining to COVID-19. Depending on the travel insurance plan purchased, the benefits and cover may differ. Full terms and conditions, as well as exclusions can be found here. For the latest travel requirements and advisories for arrival, transit or departure, please ...